Money Map Of A Non-Budgeter

Two weeks ago I confessed that I am a non-budgeter. I tried multiple ways and failed miserably. When I tried to propagate the task of tracking our expenses in an app to my wife her instant question put things into different light. “If I do that and you will see everything in the app what would that change?”. My answer was simply “nothing”. This was the moment when I realized that through the years we half-consciously developed a system which evolved with our financial situation.

I was thinking about the most simple solution to introduce this system when I bumped into this Money Map chain phenomenon which spreads like wildFIRE. It seemed a good way to do it so I made ours. But before I present that let me share a little bit of background info with you.

A FINANCIAL HISTORY RECAP

We entered the workforce roughly the same time with a couple of months difference, shortly before got married. Our financial situation was good enough. At least I thought that with my by the time mindset. Actually in this country if your starting salary covers your living expenses (imagine nothing fancy here, only the basics), provide a little bit of surplus that makes a vacation OR a used car affordable and the job itself does not give you a huge burden then you are kind of “killing it”. That was exactly our situation as a double income household, which is not impressive at all by western standards, but we were satisfied with it.

As time went by we got married and started a family. When my job status got permanent I got a raise, my salary became as much as we earned earlier combined. We made the decision that this makes it possible for her to become a stay at home mom. Thus, she did not go back to work after the maternity leave and we became a single income family. With mindful spending we kept running the same lifestyle even with a baby on board.

After two years I changed jobs and my salary doubled. By the time (thanks for the baby stuff) we outgrow our tiny apartment. We needed a little bit more space and a garden, so we started to shopping for a house. Eight months later we found a good one and moved into our current home. We used the surplus to save for the payback (we got a private loan with some grace period).

In the next two years we went through some semi-obligatory upgrades (kitchen, isolation, digging a well…) and a necessary car replacement (previous car happily turned 20 years old and started to develop some serious problems). Meanwhile I got another raise (a smaller one this time). And most importantly five months ago our second daughter born.

As you can imagine this was kind of a financial roller coaster. I will not go into detail now, let me keep the story for a future post. For now what you should know is that we paid off everything except the house loan, our monthly expenses raised only with child related costs and we were able to invest a small amount into a life insurance policy for both of us.

THE MONEY MAP

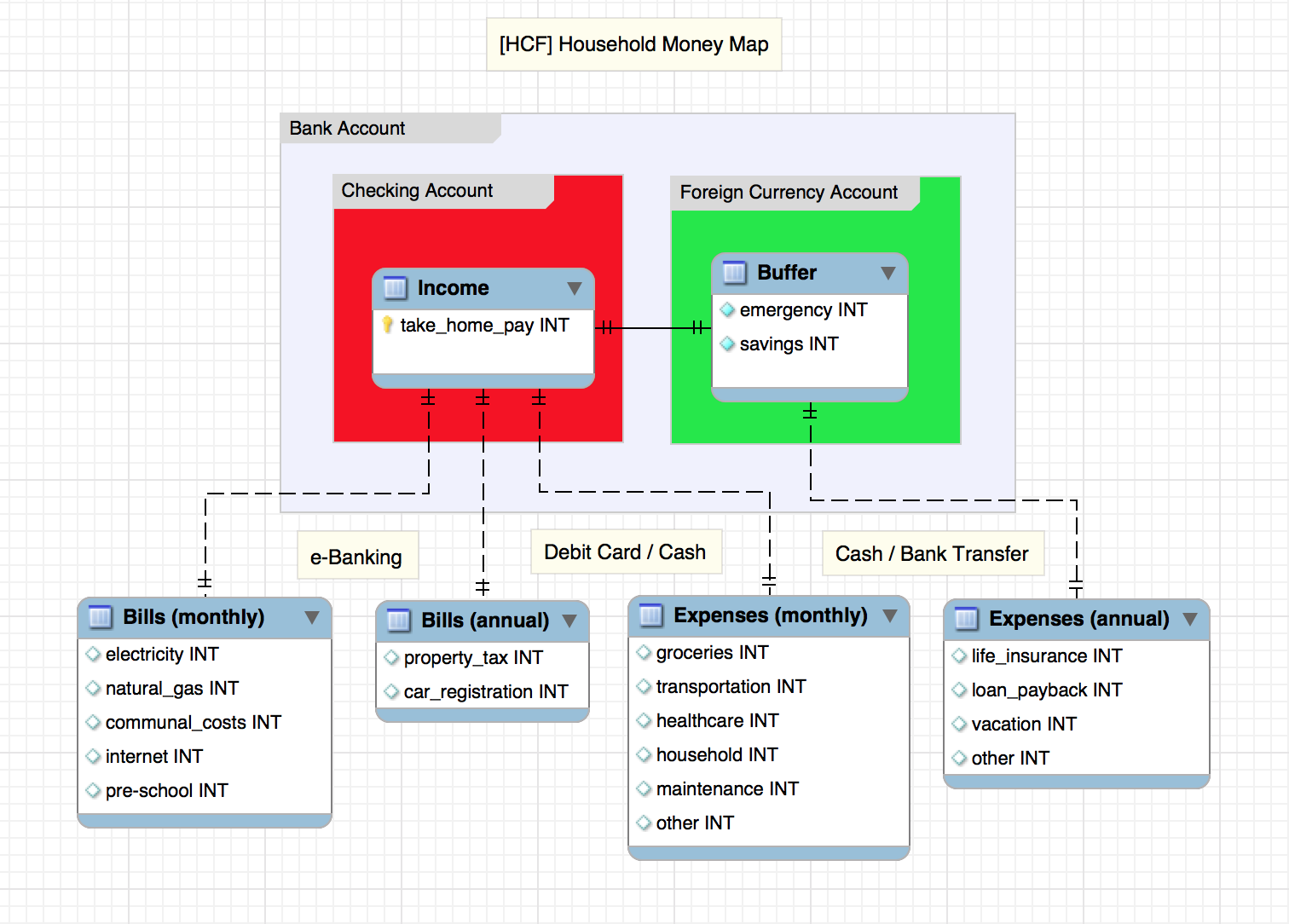

After this little warmup let me introduce our money map.

I think it is very simple and self explanatory. Maybe it looks a little bit weird, but hey, I am a coder, I can do my money map in a database designer if I want. Same time it can be technically inaccurate, that is irrelevant for money mapping purposes. Deal with it.

THE SYSTEM

To demonstrate the concept (and to look smarter) behind our system let me kick off with a quote.

It can scarcely be denied that the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without having to surrender the adequate representation of a single datum of experience.

/Albert Einstein

As a coder disassembling complex problems and make a solution in the most simple way is part of my job. I followed this methodology when we made financial decisions through the years. I don’t have records of the evolution process, what you can see on the map is the current state.

Since we became a single income family we use only one bank account which knows pretty much everything we need for free. It includes a checking account which receives my monthly payment (in local currency) and a foreign currency account (in €) which is pretty much everything else. I call that a Buffer. As I explained in this post I had to learn early on that you should not keep too much money in local currency, because shit happens sometimes.

When my take-home pay arrives at the checking account I convert half of it immediately and transfer it to the euro account. With this step, we start the month with kind of a 50% savings rate. I say kind of because this account really serves as a buffer. We use it for saving up for loan payback and insurance premiums which payments are based on euro values and come due at the end of the year. Also, it serves as a saving account, an emergency fund, as I said everything. We push and pull money from it as needed.

Usually, 35-40% of my net income covers our monthly living expenses, the rest is there for safety margin purposes. What left at the end of the month I transfer to the euro account too or use it when annual expenses like property tax payment and car registration come due. Utility and other bills monthly or annual are paid with bank transfer via e-Banking. There is an option for automation here, but I prefer doing it by hand to feel the control. 🙂

Both of us have debit cards connected with the checking account. This way we can get cash from ATMs for everyday expenses and just in case money. This is a must do here, because besides the farmers market there are a lot of places where you can not pay with a card. Where we had the option we pay everything with our debit cards as there is a minimum monthly spending requirement to waive the account management fee.

That’s all folks. We have no credit cards and besides the investment part of the life insurance policy, there are no investments either. I summarized my current standpoint on investing. I think this will not change until we pay back the house loan, so I have a couple of years for further investigation in this field.

If you point an error or have a question feel free to pick my brain in the comments below.

THE CHAIN

The Official Money Map Chain Gang:

Anchors: Apathy Ends, Budget on a Stick

#1: The Luxe Strategist

#2: Adventure Rich

#3: Minafi

#4: Othalafehu

#5: The Frugal Gene

#6: Working Optional

#7: Our Financial Path

#8: Atypical Life

#9: Eccentric Rich Uncle

#10: Cantankerous Life

#11: The Retirement Manifesto

#12: Debts to Riches

#13: Need2Save

#14: Money Metagame

#15: CYinnovations

#16: I Dream of FIRE

#17: Stupid Debt

#18: Spills Spot

#19: Making Your Money Matter

#20: Life Zemplified

#21: Trail to FI

#22: The Lady in the Black [ My personal favorite, what can I say, I am a gardening fan 🙂 ]

#23: Smile & Conquer

#24: Her Money Moves

#25: Full Time Finance

#26: Abandoned Cubicle

#27: Freedom is Groovy

#28: Millennial Money Diaries

#29: All About Balance

#30: A Journey to FI

#31: Present Value Finance

#32: [HaltCatchFire]

#33: Good Life. Better.

#34: gofi

#35: Financial Mechanic

3 thoughts on “Money Map Of A Non-Budgeter”

I am not a big fan of over thinking budgeting. I think it is a fantastic tool to show yourself where you are leaking money in your plan. However I don’t think it is necessary once you establish a consistent system. I make sure I allocate money to all my investments every month and think through any windfalls of money earned. Then I go and enjoy life. Thanks for sharing.

I cannot agree more. When you fixed the leaking of the ship you should just enjoy the ride and sometimes check the compass to be sure you are heading to the right direction. Thanks for reading.

Excellent article, I need to truly improve the content I have.

I have attempted to blog on third-party systems, it did just not transpire the true way I needed it to. However, your website has given me a desire to do this. I am bookmarking your website and check it out every once in awhile.

Many thanks!

Comments are closed.