Three financial lessons I had to learn early on

In these days when the internet is full of financial lessons, it is very hard to publish some original ones. As I stated on my introductory page repeating well-known facts is not amongst my goals so I will try to introduce you to a few new ones. From my first post, you could already know that I grew up in a little bit different economic environment than you in the US which provided me with some unique experiences. The three I picked for you are tied to the same event which I was “lucky” enough to experience.

The buying power of money is not constant

While this statement seems very self-evident the phenomenon which carved it into my mind is a little bit more complex. As you are reading a financial blog I assume you are well informed enough to know what inflation is. Yes, that little beast which constantly devours a small percentage of your money. These days it is around 2% but I bet the older folks could remember very well the recession of 1980 when this number hit the 12% rate. According to Investopedia:

Since the introduction of the CPI, the highest inflation rate observed was 19.66% in 1917.

Sounds bad, huh? Let’s play a game. Imagine a worse scenario. Like much much worse. Then add some more. What is your guess? Imagine an economic situation where inflation rates almost reach ONE. HUNDRED. PERCENT… PER DAY!

You are probably rolling your eyes now while saying this is not possible. Well, maybe it is not these days (however I would not bet on it), but let’s have a look into the not so distant past of the early 90’s. Ladies and gentlemen, let me introduce you to HYPERINFLATION. The following sentence is not a fiction.

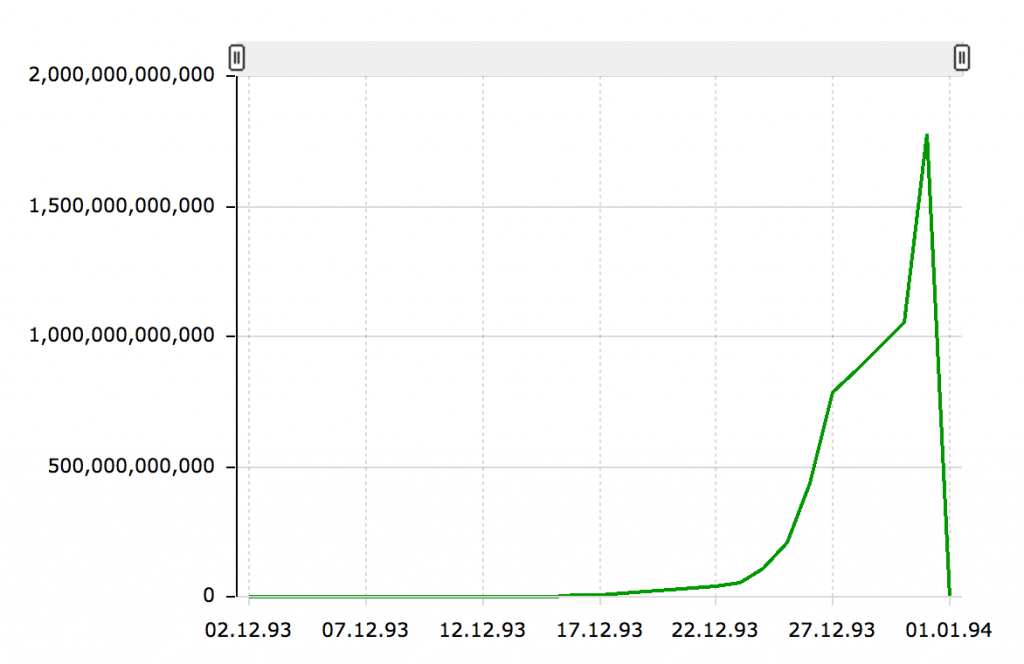

On December 31st 1993, one US Dollar worth 1,775,998,646,615 Yugoslavian Dinars, due to the highest hyperinflation has ever seen in the world (313 billion percent).

Yes, this actually happened. Right before William Bengen introduced the world the infamous 4% rule or “The Bengen Rule” (thanks, Dude). I think I am not qualified enough to explain the economical background but thanks to this gentlemen called James Lyon I don’t have to. The most economic nerds of you who are interested can read the summary of the aforementioned journalist here.

So far I only told you about the facts, but let me tell you how experiencing this was like. Before you envision an apocalyptic scene I need to calm you it was not like that or at least we kids did not recognize as such. We thought we were living as usual, my parents were working, I started attending elementary school.

Every kid at my age was comfortable with money so far, doing trips to the grocery store, buying the newspapers for grandpa at newsstand, stuff like that. The when this shit hit the fan the government started to issue new coins and banknotes with the speed of a thousand gazelles and we were hardly able to keep the pace.

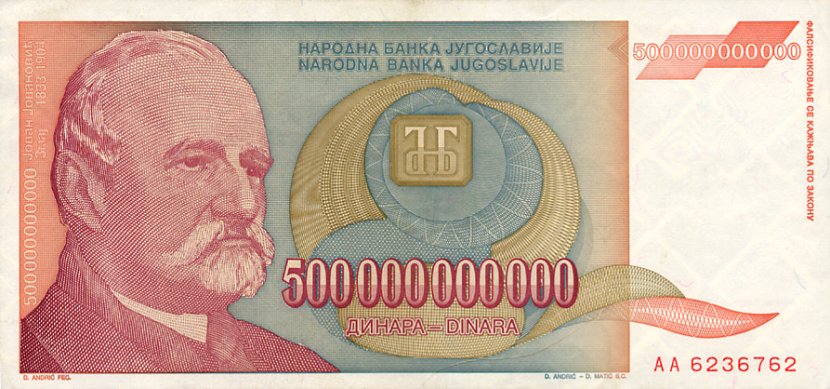

Don’t want to insert all of them here, but you can check the banknotes from those years here. We were familiar with the numbers on the banknotes from 1990, but take a look at the ones from 1992 and 1993 (hint: focus on the zeros). While it is not a big deal if a first grader cannot say the numbers in the range of millions, but it is very awkward when he asks adults about the value and they have to start counting zeros just to differentiate millions from billions. This badass was the worst of all:

The other confusing thing was that when you entered a store you never knew what the price of an item will be. In case there were any products in the store. You only went to shopping if you had some money. And you had to go quickly as your money started losing its value from the moment someone handed to you. Literally, every minute mattered. There were times after payday while earning “decent” money, when the banks paid their monthly salaries a couple of days later it was barely enough to buy a loaf of bread and a bottle of milk.

Needless to say, it has been a very motivating feeling for any employee…

Always keep your savings in stable assets

After this introduction, the legitimate question could pop up that how did we survive in this crazy era. Obviously, a lot of people suffered pretty badly. The only thing which saved us rooted in the good practice of living by our means and save some money. But you can guess that most of the people felt that the economy is pushing its limits so cautiously they changed their hard-earned dinars to more stable currencies.

The Deutsche Mark of Germany was the most popular but there were others who preferred Great British Pounds, Swiss Francs or United States Dollars. As it turned out this was a very smart move. The days of this financial roller coaster these currencies was the only valuable assets as local money sometimes worth the same as any other piece of paper, or less.

Unlike these days the best practice was not keeping your money in banks but to hide it at home. The simple reason was that banks were controlled by the government. You may guess what they did when the shortage of money hit them hard. Yes, they restricted the access to your OWN money, took your precious hard-printed foreign currency, used it for “saving the economy” and sacrificed it on the altar of hyperinflation.

Many people lost significant money because of this wrongful act. The most unfortunate ones lost everything. Still, the lack of trust forced a big part of the population to keep at least some of their savings at reach. When the hard times hit they were slowly turning these precious pieces of papers to local currency to fulfill their basic needs of food, clothing and other goods which were essential and available.

25 years passed since this rampage but we could barely forget this lesson. The economy is relatively stable these days but local currency remained still the same in the eyes of the people. A questionable kind of money used for daily and short-term usage. But ask anyone if they know how much dinars do their house or car worth. Most of them will not able to tell. Ask in euros and you will get an accurate number.

Geoarbitrage is awesome

Some may ask how come that the average people were able to save that much foreign currency which lasted long enough to survive those crazy times. Probably there are a lot of answers for this question but I know only two of them. For one in the preceding decades Yugoslavia thrived and our parents were lucky enough to grow up and start their working career in this golden era.

The jobs were solid, the salaries were ok and life was carefree in the early 80’s. However some of the older generation, including my grandfather, still struggled to get the proper job and decided to chase better options abroad and became a “gastarbeiter” in Germany. There the salaries were higher, but the cost of living too and despite he earned decent money he was not able to move the whole family abroad. He visited his family every month or so for a couple of days. I think it wasn’t a proper way of living, but he made his choice and took it for the family.

He was working abroad for over 17 consecutive years and met the requirements for german retirement. Afterwards, he moved back to home and lived leisurely for over a decade. As I recall his pension was around a thousand Deutsche Mark per month, which was a lot of money those days. Despite his wealth, he lived by his means. His biggest luxury spending was the newspaper every morning and football match tickets at weekends.

As long as I know these were the sources of those funds which made us possible to get over that financial crisis. Hard work and sacrifice brings security and stability for those who are able to exercise it. Without these qualities of theirs, I would have much more sad memories of my childhood. I am exceptionally grateful for them and feel lucky that I was able to learn this mindset at that early stage.

9 thoughts on “Three financial lessons I had to learn early on”

Great lessons. That 500 billion dinar note is crazy!

Thanks. It was. Imagine a fourth grader trying to figure out how much of these should he give the cashier for a bottle of milk. Back then I was not even able to say out these amounts. The banknotes only had nicknames. I remember once my mom was mad at me because I lost 50k dinars on the road to home from the store. By the time that was the price of a bubble gum… now it’s roughly the quarter of my salary. Crazy times…

Wow that is crazy inflation.! Those are great stories

It was crazy. Sometimes I am still amazed that it actually happened in our lifetime 🙂

In Romania, in 1993 my Dad took a loan to buy a traktor with 50% interest rate. Imagine that today…

He did pay it all back. We were lucky…

Wow, that’s high. The Hungarian minorities had their hard times everywhere. Also, it should be noted that some people ended up as winners of the situation. I heard stories about people who took out mortgages then because of the hyperinflation paid it back with new money with the value of a pack of matches… Crazy times.

Real hyperinflation – that must have been mega scary to live through. And I can’t even count all those zeros easily!

Neither did I. I was a kid back then and knew barely nothing about economics so was not bothered a lot. Same time cannot even imagine how scary would have been those days for my parents and grandparents. Just the fact that I know they lived through such times raises my already high levels of respect towards them.

Just discovered this post because just discovered you did 10 questions on 1500 blog because just discovered you mentioned me there.

Amazing post, nice story! Btw, your 500kkk Dinar bill is NOTHING compared to the Zimbabwean 100kkkk Dollars!

A hundred trillion dollars!

P.S. why nobody considered Italian Lira as a Stable Asset…. hahahahaha!

Comments are closed.